Pay federal estimated taxes online 2021

You should also check if your state requires estimated quarterly tax payments. Self-employed consultants must pay federal income and self-employment taxes along with state and local taxes.

When Is The Form 941 Due For 2021 Due Date Irs Forms Form

You can also pay using paper forms supplied by the IRS.

. Go to Your Account. In cases where payment within nine months of death would result in undue hardship to the estate we may grant an extension of up to four years. Property owners affected by COVID-19 may have late penalties cancelled if they are unable to pay their property taxes by April 10 2020.

If you are an employee your employer withholds income taxes from each paycheck based on a completed W-4 Form. It also generates four Form 1040-ES vouchers for you to use to mail estimated payments for the coming year. Heres how to pay your federal estimated taxes each quarter.

Payment plan estimated tax or other types of payments. Enjoy the convenience and flexibility of paying federal taxes by debit or credit card. Generally an extension may not exceed six months.

After youve enrolled and received your credentials you can pay any tax due to the Internal Revenue Service IRS using this system. You could potentially owe 39776 in annual federal income tax if your consultancys net profit is estimated to be 120000 in 2021 the return youll file in 2022 and if. Tax Years 2019-2021 PAY.

When you file your annual tax return youll pay the balance of taxes that werent covered by your quarterly payments. Based on reading the safe harbor rules as long as I pay in a combo of estimated taxes and w2 withholding 100 of previous year tax liability or 110 if 150K AGI I should be safe. How to pay quarterly taxes.

Beginning on April 11 2020 my office will begin accepting requests for penalty cancellation related to COVID-19 on our website. Otherwise follow the IRS instructions on Form 1040-ES to determine how much. If you use tax-preparation software from a company like HR Block and owe 1000 or more the software typically calculates estimated tax payments.

For estimated tax purposes the year is divided into four payment periods. Once youve calculated your quarterly payments You can submit them online through the Electronic Federal Tax Payment System. You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app.

Pay IRS installment agreements and other personal and business taxes quickly easily. I have already realized 60K in cap gains in 2021 and may realize another 30K although this is. For individual taxpayers in Q4 2022 the rate for overpayments and underpayments will be 6 per year compounded daily up from 5 in Q3 2022.

Employers Quarterly Federal Tax Return Form W-2. Usually thats enough to take care of your income tax obligations. Pay your taxes view your account or apply for a payment plan with the IRS.

Its fast easy and secure. The general rule of thumb is that you should pay estimated taxes if its likely that youll owe the IRS 1000 or more when you file your tax return. No fees from IRS.

Learn when federal estimated quarterly tax payments are due. When To Pay Estimated Taxes. Department of the Treasury.

Corporations generally use Form 1120-W to figure estimated tax. 1040X - Amended Return - Tax Years 2019-2021. Heres a closer look at how taxes work for consultants.

How to Estimate Your Taxes. Pay your IRS 1040 taxes online using a debit or credit card. Estates may apply for an extension of time to file the return pay the tax or both using Form ET-133 Application for Extension of Time to File andor Pay Estate Tax.

The top 20 of taxpayers paid 78 of federal income taxes in 2020 according to the Tax Policy Center up from 68 in 2019. Find out what you need. When its time to make a tax payment you have a few options.

But if you are self-employed or make money on your investments or rental property you may need to make estimated tax payments every quarter rather than wait until you file. The top 1 of taxpayers paid 28 of taxes in 2020 up from 25 in 2019. The Electronic Federal Tax Payment System tax payment service is provided free by the US.

Refer to the IRS website for official dates. Pay from Your Bank Account.

What Does 11 Form Look Like What Does 11 Form Look Like Is So Famous But Why Tax Forms Irs Tax Forms Income Tax Return

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

To Win At The Tax Game Know The Rules Published 2015 Income Tax Return Irs Tax Forms Tax Forms

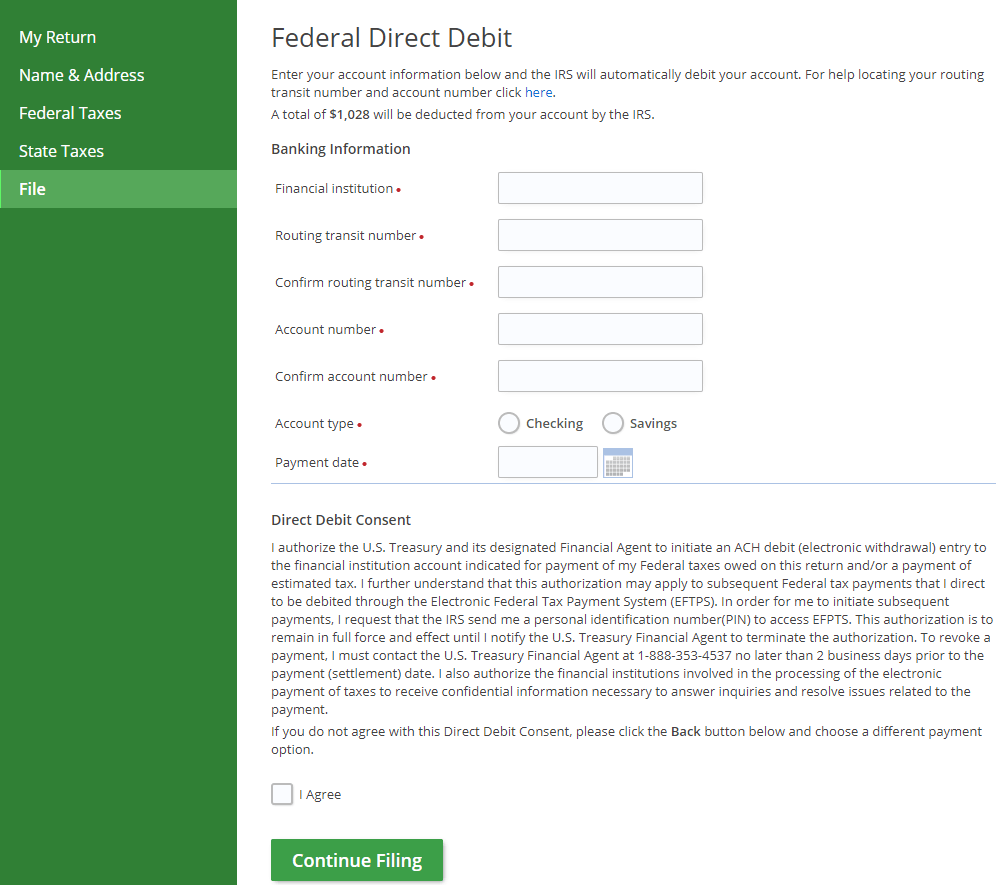

Pay For Taxes Via Direct Pay Credit Card Or Payment Plan

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

2018 2021 Form Irs W 9 Fill Online Printable Fillable Blank Pdffiller Fillable Forms Calendar Template Calendar Printables

3rd Quarter Form 941 Changes Irs Forms Payroll Taxes Irs

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

2

How To Pay Federal Estimated Taxes Online To The Irs In 2022 Estimated Tax Payments Online Taxes Tax Help

Estimated Income Tax Payments For 2022 And 2023 Pay Online

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Form 1040 Es Paying Estimated Taxes Jackson Hewitt

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

Minnesota W4 Form 2021 W4 Tax Form Tax Forms Filing Taxes

Publication 505 2021 Tax Withholding And Estimated Tax Internal Revenue Service Worksheets Consumer Math Adjective Worksheet

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Income Tax